Business editor and business reporter, BBC News

Getty Images

Getty ImagesBP has announced it will cut its renewable energy investments and instead focus on increasing oil and gas production.

The energy giant revealed the shift in strategy on Wednesday following pressure from some investors unhappy its profits and share price have been lower than its rivals.

BP said it would increase its investments in oil and gas by about 20% to $10bn (£7.9bn) a year, while decreasing previously planned funding for renewables by more than $5bn (£3.9bn).

The move comes as rivals Shell and Norwegian company Equinor have also scaled back plans to invest in green energy and US President Donald Trump’s “drill baby drill” comments have encouraged investment in fossil fuels.

Murray Auchincloss, BP’s chief executive, said the energy giant would be “very selective” in investing in businesses working on the energy transition to renewables going forward, with funding reduced to between $1.5bn and $2bn per year.

He said this was part of a strategy “reset” by the company to focus on boosting returns for shareholders.

Helge Lund, chair of BP, added that the new direction of the firm had “cash flow growth” at its heart.

Shares in the company climbed before Tuesday’s announcement but fell shortly after.

BP is one of several firms in the energy industry to return focus on oil and gas production, which has seen an increase in profits as prices have increased following lows seen during the Covid pandemic.

The firm said it plans to increase its production to between 2.3 million and 2.5 million barrels of oil per day by 2030, with hopes of “major” oil and gas projects starting by the end of 2027.

Mr Auchincloss is under pressure to boost profits from some shareholders, including the influential activist group Elliot Management, which took a near £4bn stake in the £70bn company to push for more investment in oil and gas.

In 2024, BP’s net income fell to $8.9bn (£7.2bn), down from $13.8bn the previous year.

However, some other shareholders, as well as environmental groups have voiced concerns over switching focus back to fossil fuel production.

Last week, a group of 48 investors called on the company to allow them a vote on any potential plans to move away from commitments to renewables.

The environmental group Greenpeace UK said the latest move was “proof that fossil fuel companies can’t or won’t be part of climate crisis solutions”.

Alexander Kirk from Global Witness added BP “cannot be trusted to deliver the clean energy transition”, adding that it was “focusing on short-term profits to shareholders while energy prices are high, with the rest of the world picking up the tab from its climate-wrecking products”.

‘Not just down to one company’

Challenged on the reduced commitment to investing in renewable energy, Louise Kingham, BP’s senior vice president for Europe and the UK, said none of the changes announced on Tuesday would alter the UK’s green energy plans, which include three wind farms and carbon capture projects.

She said the shift to renewable energy sources had slowed but that BP’s ambition had “not changed” to become a net-zero company.

According to the International Energy Agency, no new fossil fuel projects are compatible with limiting global warming to 1.5C compared to pre-industrial levels,

“We just have to do this transition more smartly and more efficiently and try to get those returns for our owners because they are helping us to do that. If we don’t generate the returns, we can’t invest and do more,” Ms Kingham told a committee of MPs.

“It’s going to take everybody to move in concert to make this happen. It’s not just the decision of one company and what it chooses to do.”

The decrease in renewables will cover biogas, biofuels and electric vehicle charging projects, while BP will look to “capital-light partnerships” in other green energy such as wind and solar.

BP has already placed its offshore wind business in a joint venture with Japanese company Jera and is looking to find a partner to do the same with its solar business.

Five years ago, BP set some of the most ambitious targets among large oil companies to cut production of oil and gas by 40% by 2030, while significantly ramping up investment in renewables.

But in 2023, the company lowered this oil and gas reduction target to 25%.

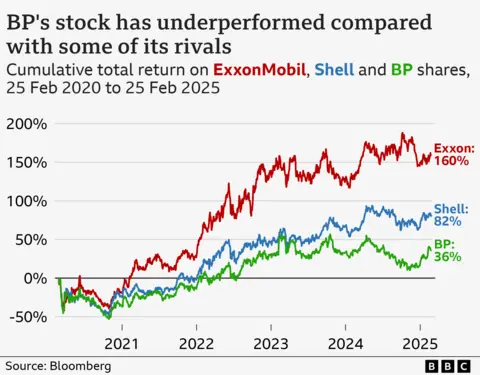

In the five years since former chief executive Bernard Looney first unveiled his strategy, shareholders have received total returns including dividends of 36%.

In contrast, shareholders in rivals Shell and Exxon have seen returns of 82% and 160% respectively.

BP’s under performance has prompted speculation that it may be a takeover target or may consider moving its main stock market listing to the US where oil and gas companies command higher valuations.

‘Science hasn’t changed’

Sir Ian Cheshire, who has held many executive roles at companies such as B&Q owner Kingfisher and Barclays bank, questioned whether BP’s latest move would work.

“I do wonder whether this sort of decision will look right in 10 years,” he told the BBC’s Today programme, added that the “overall energy transition” to renewables was “still going to come”.

“The climate change issue has not gone away, the science hasn’t changed,” he said.